Loading

Get Fidelity Recharacterization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Recharacterization online

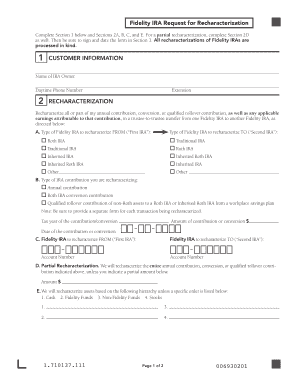

Navigating the Fidelity Recharacterization can be crucial for managing your IRA contributions effectively. This guide will provide you with step-by-step instructions to help ensure that you complete this process accurately and efficiently.

Follow the steps to successfully fill out the form.

- Press the ‘Get Form’ button to access the Fidelity IRA Request for Recharacterization form and open it in your preferred document editor.

- In Section 1, fill in your name as the IRA owner and provide your daytime phone number. Ensure all information is accurate to avoid delays.

- Move to Section 2. Indicate the amount you wish to recharacterize and specify whether it is from your annual contribution, conversion contribution, or a qualified rollover contribution.

- In Section 2A, select the type of Fidelity IRA from which you are recharacterizing contributions (the First IRA) and the type to which you are recharacterizing these contributions (the Second IRA). Choose from the provided options.

- For Section 2B, specify the exact amount of the contribution you are recharacterizing and include the tax year as well as the date of the original contribution.

- In Section 2C, input the account numbers for both the First IRA and the Second IRA to ensure proper processing.

- If applicable, complete Section 2D for a partial recharacterization by specifying the amount you wish to recharacterize if it is less than the total.

- In Section 2E, follow the provided hierarchy for recharacterizing assets or indicate a specific order if you have preferences.

- Finally, in Section 3, be sure to sign and date the form. Without your signature, the recharacterization will not be processed.

Start your recharacterization process online today by following these guidelines.

Related links form

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA (either a Roth or traditional) in a trustee-to-trustee transfer or to a different type of IRA with the same trustee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.