Loading

Get Flex Spending Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flex Spending Form online

Filling out the Flex Spending Form online can streamline your reimbursement process for eligible health expenses. This guide will walk you through the essential steps to ensure accuracy and efficiency in completing your form.

Follow the steps to accurately complete your Flex Spending Form.

- Click the ‘Get Form’ button to access the Flex Spending Form and open it for editing.

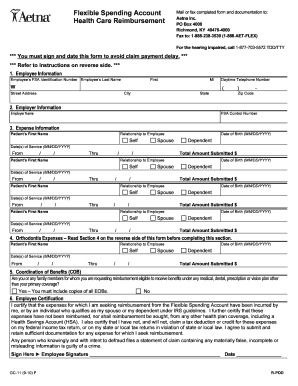

- In the Employee Information section, enter your FSA Identification Number, your last name, first name, middle initial, daytime telephone number, street address, city, state, and zip code.

- Move to the Employer Information section. Fill in the employer name and your FSA Control Number, which can often be found on previous documentation or by contacting your employer.

- Proceed to the Expense Information section. For each patient, provide their first name, date of birth, relationship to you (select from self, spouse, or dependent), and detail the dates of service along with the total amount you are submitting for reimbursement.

- If applicable, complete the Orthodontia Expenses section. Provide the patient’s first name, date of birth, relationship to you, service dates, and the total amount submitted. Ensure to attach necessary documentation as specified.

- In the Coordination of Benefits (COB) section, indicate whether any family members are eligible for additional benefits from another health plan. If yes, include copies of all Explanation of Benefits (EOBs).

- Complete the Employee Certification by reading the statement carefully, signing, and dating the form to avoid any claim payment delays.

- After filling out all necessary sections, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your Flex Spending Form online today for swift and hassle-free reimbursement.

A flexible spending arrangement (FSA) allows employees to get reimbursed for medical or dependent care benefits from an account they set up with pre-tax dollars. The salary-reduction contributions are not included in your taxable wages reported on Form W-2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.