Loading

Get Wealthtrac Employer Superannuation Contributions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WEALTHTRAC EMPLOYER SUPERANNUATION CONTRIBUTIONS online

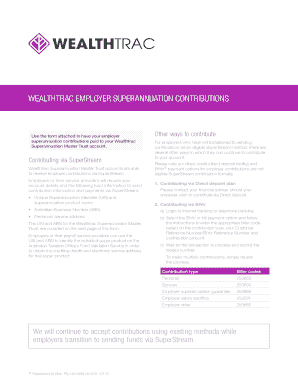

This guide provides detailed instructions on completing the WEALTHTRAC EMPLOYER SUPERANNUATION CONTRIBUTIONS form. Whether you are new to superannuation or looking to update your contributions, this guide will assist you through each step.

Follow the steps to complete your contributions form effectively.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter your account details in the 'Client account details' section. This includes your account name, account number, and Member Customer Reference Number or BPAY Reference Number, which can be obtained from your adviser or the Client Online Portal.

- Fill in the address section with your suburb, state, and postcode to ensure accurate processing.

- Provide the contribution details by indicating that all future superannuation contributions should be directed to the Wealthtrac Superannuation Master Trust, including the ABN 81 154 851 339 and the USI OAM0001AU.

- Affix your signature and date in the designated areas at the bottom of the form.

- Lastly, submit the completed form to your employer to initiate the contributions process.

Begin filling out your WEALTHTRAC EMPLOYER SUPERANNUATION CONTRIBUTIONS form online now.

Under the superannuation guarantee, employers have to pay superannuation contributions of 10.5% of an employee's ordinary time earnings when an employee is: over 18 years, or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.