Loading

Get K 1e

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K 1e online

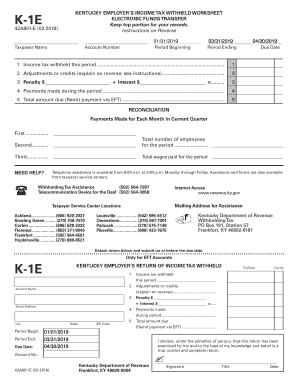

Filling out the K 1e form is an essential task for employers who need to report income tax withheld in Kentucky. This guide provides clear, step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to successfully complete the K 1e form online.

- Click ‘Get Form’ button to obtain the K 1e and open it in the editor.

- Begin by entering your taxpayer name and account number in the designated fields. Ensure that these details are accurate to avoid any processing issues.

- Fill out the period beginning and period ending dates. This section is crucial for reporting the correct time frame for your tax calculations.

- In line 1, input the total income tax withheld during this reporting period. Be sure to double-check this figure for accuracy.

- On line 2, note any adjustments or credits. If necessary, provide a brief explanation on the reverse side of the form.

- Calculate the penalty (if applicable) and interest for late payments in line 3. Ensure that you understand the penalties for any delays in remittance.

- Enter total payments made during the reporting period in line 4. This should reflect all payments remitted via electronic funds transfer (EFT).

- Complete line 5 by summarizing the total amount due, ensuring it aligns with any previous calculations.

- Move to the reconciliation section. Here, list the payments made for each month of the current quarter and total wages paid for the reporting period.

- Lastly, review all information for accuracy, and print the completed K 1e form. Save changes if working digitally, and be prepared to submit it prior to the due date.

Start completing your K 1e form online today to ensure timely and accurate tax reporting.

Check here once Form K-4 has been completed and attached. I am a resident of Kentucky and wish to be exempted from Kentucky state income tax withholding. All Kentucky wage earners are taxed at a flat 4.5% rate with a standard deduction allowance of $2,980.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.