Loading

Get Wt 7 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wt 7 Form online

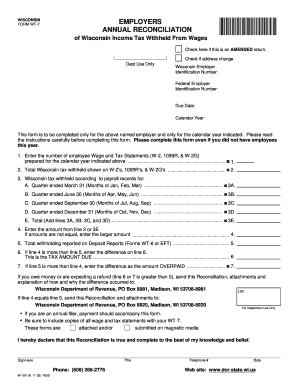

Completing the Wt 7 Form online is a straightforward process that helps employers reconcile Wisconsin income tax withheld from wages. This guide provides clear, step-by-step instructions to assist users in filling out the form accurately and efficiently.

Follow the steps to complete the Wt 7 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your web browser.

- Indicate whether this is an amended return or if there is an address change by checking the appropriate box.

- Enter your Wisconsin Employer Identification Number and Federal Employer Identification Number in the designated fields.

- Provide the due date and calendar year for which the form is being completed.

- Input the number of employee Wage and Tax Statements (W-2, 1099R, & W-2G) prepared for the indicated calendar year.

- Enter the total Wisconsin tax withheld as shown on the W-2s, 1099Rs, and W-2Gs.

- Fill in the amounts of Wisconsin tax withheld according to payroll records for each quarter of the calendar year.

- Calculate the total withholding by adding the quarterly amounts from step 7.

- Compare the total reported tax withheld with the total from deposit reports (Forms WT-6 or EFT) and enter any differences.

- If you owe additional tax or have overpaid, indicate the amounts on the respective lines.

- Sign and date the form, confirming that the information provided is true and complete.

- Upon completion, save any changes made to the form. You can then download, print, or share the form as needed.

Begin the process of filling out your Wt 7 Form online today!

Withholding deposit reports (Form WT-6) are required to be filed electronically using an approved submission method which include My Tax Account, Telefile, or e-File Transmission. When filing electronically, be sure to: ... Fill in the period covered by the report.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.