Loading

Get Hardship Letter Sample

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hardship Letter Sample online

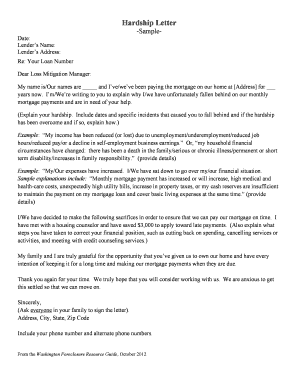

Filling out a hardship letter can be a crucial step in explaining your financial difficulties to a lender. This guide will provide you with step-by-step instructions to help you navigate through the Hardship Letter Sample effectively and efficiently.

Follow the steps to easily complete your hardship letter

- Click ‘Get Form’ button to obtain the Hardship Letter Sample and open it in the designated editor.

- Begin by filling in the date at the top of the document. This identifies when the letter is being sent.

- Fill out the lender's name and address. This ensures the letter reaches the correct recipient and maintains professionalism.

- Under 'Re: Your Loan Number', include your loan number to help the lender identify your account easily.

- Start the body of your letter with a salutation, addressing the Loss Mitigation Manager. This sets a respectful tone.

- Introduce yourself by stating your name(s) and how long you have been paying the mortgage on your home. This builds context for your situation.

- In the hardship explanation section, describe the specific circumstances that led to your payment difficulties, providing relevant dates or incidents.

- Include details about any changes to your income or financial circumstances, as well as any sacrifices you have made to manage your finances.

- Articulate any positive steps you are taking to rectify your situation, such as working with a housing counselor or adjusting your budget.

- Express your gratitude for the opportunity to own a home and your willingness to resolve this matter. This helps convey sincerity and commitment.

- Conclude your letter with a polite closing and make sure everyone involved signs the letter to validate the request.

- Lastly, provide your contact information, including your address, phone numbers, and any alternate contact methods.

Start filling out your hardship letter sample online today to take the first step towards addressing your financial challenges.

Lender guidelines almost always require the borrower to have experienced a hardship that has made the current payment amount unaffordable. A valid financial hardship is an event that was generally unavoidable or outside of your control, like the death of a coborrower, job loss, or a divorce. Ability to pay.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.