Loading

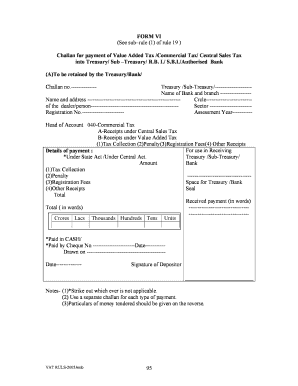

Get Form Vi (see Subrule (1) Of Rule 19 ) Challan For Payment Of Value Added Tax /commercial Tax/

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FORM VI (See Subrule (1) Of Rule 19 ) Challan For Payment Of Value Added Tax /Commercial Tax/ online

Filling out the FORM VI Challan for payment of Value Added Tax or Commercial Tax is an essential step for compliance. This guide will provide you with a comprehensive overview and clear instructions to navigate each section of the form with ease.

Follow the steps to successfully complete the FORM VI Challan online.

- Click the ‘Get Form’ button to access the online version of the FORM VI Challan. This will allow you to view and edit the form as needed.

- Begin filling out the form by entering the Challan number in the designated field at the top. This number is crucial for tracking your payment.

- Provide the name of the Treasury or Sub-Treasury where the payment will be made. Include the name of the bank and its branch as well.

- Fill in your name and address, along with the Registration Number associated with your tax profile. This information helps in properly associating the payment with your records.

- Indicate the Assessment Year for which the payment is being made. This is important for financial accuracy.

- Select the Head of Account: choose between Receipts under Central Sales Tax or Receipts under Value Added Tax, as applicable.

- Outline the payment details by specifying amounts for each category: Tax Collection, Penalty, Registration Fees, and Other Receipts.

- In the section marked for payment details, write the total amount in numerical form and also spell it out in words for clarity.

- Select your mode of payment, whether it will be by cash or cheque. If paying by cheque, enter the cheque number, date, and the bank it is drawn on.

- Finally, sign the form where indicated as the depositor, confirming the correctness of the provided details.

- Once you have completed all sections, ensure to save the changes made on the form. You have the option to download, print, or share the completed Challan as necessary.

Start filling out your FORM VI Challan online to ensure compliance with tax regulations.

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.