Loading

Get Form 8908

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8908 online

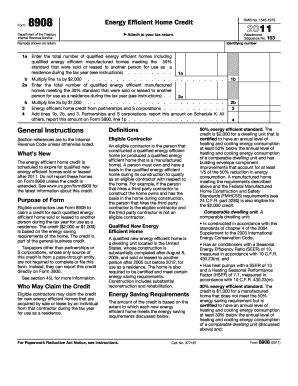

Filling out the Form 8908, which is used to claim the energy efficient home credit, can be straightforward if you follow the right steps. This guide provides clear and detailed instructions to help you successfully complete the form online.

Follow the steps to fill out Form 8908 online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your name(s) as shown on your tax return. This identification is crucial for processing your claim.

- For line 1a, enter the total number of qualified energy efficient homes you sold or leased during the tax year. Ensure you include homes that meet the 50% energy saving standard.

- Multiply the number entered in line 1a by $2,000 to calculate the credit amount for these homes and enter this value in line 1b.

- For line 2a, enter the total number of qualified energy efficient manufactured homes that comply with the 30% energy saving standard.

- Multiply the value from line 2a by $1,000 and input the result in line 2b.

- If applicable, enter any energy efficient home credit amounts received from partnerships or S corporations on line 3.

- Finally, add the amounts from lines 1b, 2b, and 3, then enter this total on line 4, which is used for reporting on your overall tax return.

- After completing all sections, review your entries for accuracy before saving changes, downloading, or printing the form for your records.

Complete your document filing requirements by efficiently filling out Form 8908 online today.

Related links form

The 179D commercial buildings energy efficiency tax deduction primarily enables building owners to claim a tax deduction for installing qualifying systems and buildings. Tenants may be eligible if they make construction expenditures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.