Loading

Get A Form 990 (except Black Lung Benefit Trust Or Private Foundation) Sponsoring Organizations, And

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Form 990 (except Black Lung Benefit Trust Or Private Foundation) Sponsoring Organizations online

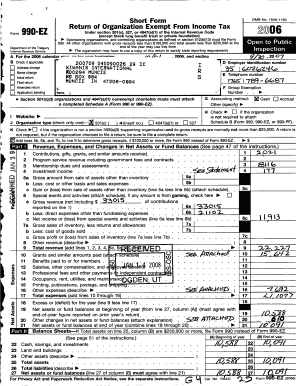

Filling out Form 990 is essential for nonprofit organizations to report their financial information to the IRS. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring compliance with regulatory requirements.

Follow the steps to complete the form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the organization's name and address accurately in the designated fields. This information is crucial for proper identification.

- Specify the organization type by checking the appropriate box that reflects its classification, such as 501(c)(3) or 501(c)(4).

- Input the Employer Identification Number (EIN) and telephone number to ensure the IRS can contact the organization if necessary.

- Select your accounting method (cash or accrual) and indicate if the organization is exempt from attaching Schedule B.

- Fill out the revenue section: report all sources of income such as contributions, service revenue, and other revenue in the respective fields.

- Complete the expenses section by accurately reporting costs related to functioning, including salaries, professional fees, and grants paid.

- Provide details on program services accomplished by describing the primary exempt purpose of the organization and the services provided to individuals.

- List the names and titles of directors and key employees, ensuring to include compensation details, if applicable.

- Review each section for accuracy and completeness, ensuring all necessary attachments are included, particularly for organizations that engage in foreign grants.

- Once all information is complete and confirmed, save any changes, download, print, or share the form as needed for submission.

Complete your Form 990 online today to maintain compliance and transparency in your organization's financial reporting.

A 501 (c) (3) nonprofit will always file a 990—either a 990-EZ, 990-N Postcard, 990-PF (private foundation), or full 990 form, depending on their total gross receipts for the tax year. Many other 501 and nonprofit organizations file a 990.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.