Loading

Get Nab Classic Banking

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NAB Classic Banking online

This guide provides clear instructions on how to complete the NAB Classic Banking form online. Whether you are applying for personal or business accounts, these steps will ensure you can navigate the process smoothly.

Follow the steps to successfully fill out your NAB Classic Banking form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

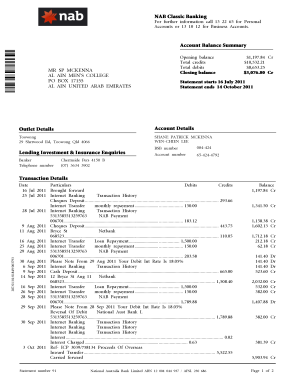

- Begin by entering your personal information. This includes your full name, address, and contact details to ensure accurate communication from NAB.

- Next, provide your account details. This section requires you to input your BSB number and account number, which can be found on your previous bank statements or online banking platform.

- Additionally, include your opening balance, total credits, and total debits as stated in your previous financial statements. This information is critical for ensuring your account records are up to date.

- Review the transaction details section. Here, summarize your recent transactions, including dates, particulars, debits, and credits. Accurate reporting of these details is essential for maintaining proper financial records.

- Once you have completed all sections of the form, review the information for accuracy. It is important to confirm that all entries are correct to avoid any issues with your application.

- After verifying your information, save the changes to your document. You may then choose to download, print, or share the completed form as needed.

Complete your NAB Classic Banking documents online today for a streamlined banking experience.

This will appear as Overdraft Item or Return Item Charge on your statement. $38.50 Per transaction, for 3+ overdraft or non-sufficient funds transactions in the current or last 11 statement cycles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.