Loading

Get B C 786

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the B C 786 online

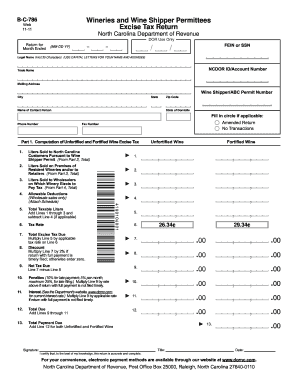

Filling out the B C 786 form is a crucial responsibility for wineries and wine shipper permittees in North Carolina. This guide provides a step-by-step approach to completing the form accurately and effectively, ensuring compliance with the state's excise tax reporting requirements.

Follow the steps to successfully complete the B C 786 form.

- Click the ‘Get Form’ button to access the B C 786 form and open it in the designated editor.

- Fill in the return month by entering the appropriate month and year in the specified format (MM-DD-YY).

- Enter your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as required in the designated fields.

- Complete the 'Legal Name' section by entering the winery's official name in capital letters, followed by the NCDOR ID or account number.

- Input the trade name of your winery, along with the mailing address, including city, state, and zip code.

- Provide details about your wine shipper or ABC permit number.

- Fill in the 'Contact Person' section by entering the name and phone number of the person to be contacted regarding the return.

- Complete the computation sections by entering liters sold based on the provided definitions for unfortified and fortified wines. These should correspond to the details from Parts 2, 3, and 4.

- Calculate the total taxable liters by adding lines 1 through 3 and subtracting any allowable deductions listed in line 4.

- Determine the total excise tax due by multiplying the total taxable liters by the applicable tax rate.

- Calculate any applicable penalties and interest for late payments, and sum these amounts to find the total due.

- In the certification section, confirm the accuracy of the information provided and sign the form, also indicating the title and date.

- Review all entries for completeness before saving changes, then consider downloading, printing, or sharing the completed form.

Complete your B C 786 form online today to ensure timely and accurate reporting of your wine sales.

How do I calculate the excise tax on a property? The current North Carolina excise tax stamps are $1.00 per $500.00 or fractional part of the value of the property conveyed. For deeds recorded prior to August 1991, the excise tax was $1.00 per thousand.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.