Loading

Get Disclosure Statement For Small Business Under Chapter 11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Disclosure Statement For Small Business Under Chapter 11 online

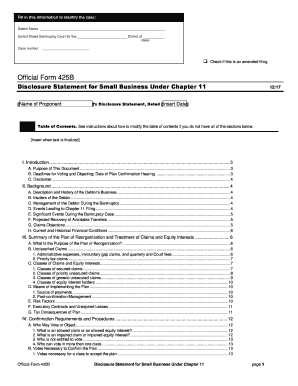

Completing the Disclosure Statement for Small Business Under Chapter 11 can be a crucial step for small businesses navigating bankruptcy proceedings. This guide provides clear and supportive instructions to help you fill out the form accurately and efficiently online.

Follow the steps to complete the disclosure statement effectively.

- Click 'Get Form' button to access the disclosure statement and open it in the editor.

- Fill in the debtor name in the designated field at the top of the form to identify the business involved.

- Specify the United States Bankruptcy Court district in which the case is filed by filling in the appropriate information.

- Enter the case number assigned to your bankruptcy case in the designated section to ensure proper tracking.

- Indicate if this is an amended filing by checking the corresponding box if applicable.

- Complete the table of contents as instructed, making sure it reflects all sections included in the document.

- Provide detailed information in each section, including background details of the debtor's business, insiders, management, and significant events leading up to the bankruptcy filing.

- Summarize the plan of reorganization, detailing how claims and equity interests will be treated under the plan.

- List confirmation requirements and procedures, including who may vote or object to the plan.

- Complete additional sections and exhibits as necessary, and review all entries for accuracy before finalizing.

- Once finished, save your changes, download, print, or share the completed form as needed to ensure compliance with all requirements.

Start completing your Disclosure Statement online today to navigate your Chapter 11 bankruptcy process with confidence.

The disclosure statement in a Chapter 11 bankruptcy case is designed to give creditors adequate information about the debtors finances. ... The disclosure statement provides "adequate information" about your affairs so creditors can make an informed decision about your reorganization plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.