Loading

Get Form 901

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 901 online

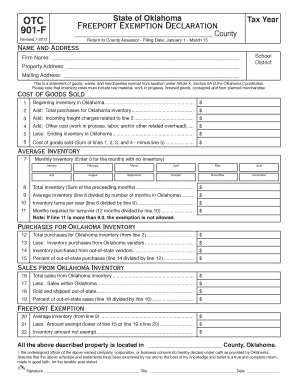

Filling out the Form 901, the Freeport Exemption Declaration, is an essential step for businesses to claim tax exemptions on certain goods in Oklahoma. This guide will walk you through the process of completing the form online, ensuring accurate submission to avoid any issues.

Follow the steps to effectively complete Form 901 online.

- Click ‘Get Form’ button to access the form and open it in your online editor.

- Begin by entering the tax year and the county in which you are filing the exemption. This information is crucial for categorizing your claim correctly.

- Fill in the firm name, your property address, and mailing address. Ensure that all details are accurate to facilitate communication about your application.

- In the section titled 'Cost of Goods Sold,' provide information regarding your beginning inventory, purchases, freight charges, and ending inventory in Oklahoma. Carefully calculate the cost of goods sold by following the equations presented for each line.

- Record your monthly inventory for each month of the year, entering 0 for any months where there was no inventory. Use the totals to calculate your average inventory and inventory turns per year.

- Complete the purchases for Oklahoma inventory section, including total purchases, deductions for in-state purchases, and calculating the percent of out-of-state purchases.

- Proceed to the sales from Oklahoma inventory section, documenting total sales, sales shipped out-of-state, and calculating the percent of out-of-state sales.

- In the freeport exemption section, complete the fields related to average inventory and exempt amounts. This information will determine your qualification for the exemption.

- Finally, ensure that the declaration statement is signed by the authorized officer of the company. Include their title and the date of submission.

- After confirming that all fields are accurately filled out, save your changes, download a copy, and print the form for your records. If needed, share it with relevant parties.

Complete your documents online today to ensure timely submission and to take advantage of available exemptions.

The taxpayer completes Form 901 listing the original cost of the assets of the business concern. ... The 901 form must be prepared by an owner, partner, officer of the corporation or a bona fide agent. The form must be returned to our office by March 15 to avoid penalty. Get 901 Instruction sheet.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.