Loading

Get Heloc Early Disclosure Model Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Heloc Early Disclosure Model Form online

Filling out the Heloc Early Disclosure Model Form online can be a straightforward process with the right guidance. This form is essential for understanding the terms and conditions associated with your home-equity line of credit, ensuring clear communication between you and the creditor.

Follow the steps to accurately complete the form online.

- Press the ‘Get Form’ button to access the Heloc Early Disclosure Model Form and open it in an online editor.

- Enter the loan applicant’s name in the designated field. This should reflect the legal name of the individual applying for the home-equity line of credit.

- Fill in the loan applicant’s address accurately to ensure proper communication regarding the credit account.

- Input the date of the application. Ensure this is the current date or the date that you are completing the form.

- Provide the name of the creditor who will be offering the home-equity line of credit.

- Include the loan originator’s unique identifier, which is a critical component that links your application to the correct lender.

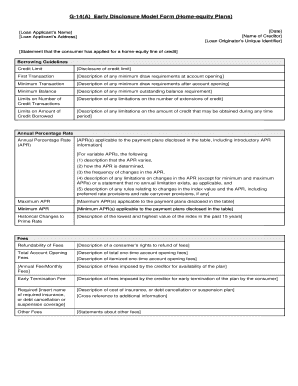

- Review the borrowing guidelines meticulously, entering the credit limit and other specified minimum transaction and balance requirements as indicated.

- Fill out the annual percentage rate (APR) fields based on the terms disclosed, ensuring to provide details on any variable rates, maximum and minimum APRs.

- Complete the fees section, detailing the total account opening fees, any annual or monthly fees, and any specific early termination fees that may apply.

- Detail the borrowing and repayment terms, including the length of the credit plan, payment plans available, and any risk disclosures related to the use of the line of credit.

- Once all fields are filled out, carefully review the entire form for accuracy to ensure the information is correct and complete.

- Save your changes, and choose the option to download, print, or share the completed form as needed.

Start filling out the Heloc Early Disclosure Model Form online today to stay informed about your home-equity line of credit.

There are three interdependent disclosures that are important to the home equity line of credit product: the Home Equity Line of Credit Early Program Disclosure, Account Opening Disclosures or credit agreement, and the billing statement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.