Loading

Get Mw508

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw508 online

Filling out the Mw508 form online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide will lead you through each section of the form, ensuring you provide all necessary information accurately.

Follow the steps to successfully fill out the Mw508 online.

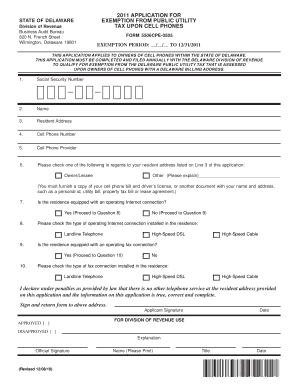

- Click the ‘Get Form’ button to access the Mw508 and open it in your preferred editor. This will allow you to begin the process of completing the form online.

- Enter the social security number of the person claiming the exemption in the designated field. Ensure that the number is accurate to avoid processing delays.

- Provide the name of the individual claiming the exemption. This should match the identification provided.

- Fill in the resident address of the person claiming the exemption, ensuring it is a valid address, not a post office box.

- Input the cell phone number of the individual requesting the exemption. This should be the active number associated with the exemption.

- Indicate the name of the cell phone provider currently providing service to the individual. Accurate information is crucial for processing.

- Check the appropriate box regarding the residency status. You may select 'Owner/Lessee' if you own or lease the property or 'Other' with an explanation for your residency.

- Confirm if an operating internet connection is present at the residence by selecting 'Yes' or 'No' and proceed accordingly.

- If applicable, specify the type of internet connection in use, such as landline telephone, high-speed DSL, or high-speed cable.

- Repeat for the fax connection: indicate if one exists and specify the type of connection if applicable.

- After providing all the necessary information, review the form for accuracy. Sign the declaration to affirm the truthfulness of the information provided.

- Save changes to your completed Mw508 form. You may then download, print, or share the form as required.

Complete your Mw508 document online today to ensure you maintain your exemption status.

Related links form

You are required to fill out a MW506 form on an accelerated, monthly, quarterly, seasonal or annual basis, depending upon the amount of tax withheld. You must file your MW506 form by the due dates, even if no tax was withheld. If no tax is due, file by telephone by calling 410-260-7225.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.