Loading

Get Money Laundering Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Money Laundering Form online

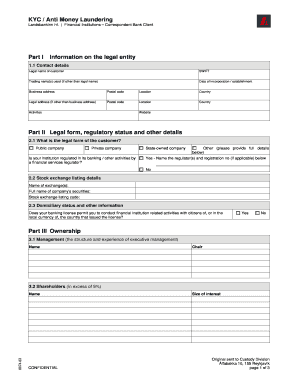

Filling out the Money Laundering Form online is an important step in ensuring compliance with anti-money laundering regulations. This guide provides clear and instructional steps to help you complete each section of the form accurately and efficiently.

Follow the steps to complete the Money Laundering Form.

- Click the 'Get Form' button to obtain the Money Laundering Form and open it in your preferred digital editor.

- Begin with Part I, providing your legal entity's contact details, including the legal name, trading names, incorporation date, business address, postal code, location, country, legal address, activities, and website.

- In Part II, specify the legal form of your institution (public company, private company, etc.). Indicate if your institution is regulated and provide the name of the regulator if applicable.

- Fill out the stock exchange listing details, including the name of the exchange, the full name of the company’s securities, and the listing code.

- Complete the domiciliary status section by confirming whether your banking license allows transactions with local citizens or currency.

- Proceed to Part III and provide information about management and ownership by listing names, the size of interests, and any foreign subsidiaries or branches.

- In Part IV, review and answer questions regarding your institution's anti-money laundering controls, including compliance with local laws, internal audits, and training policies.

- Ensure all necessary documentation, such as incorporation certificates and articles of association, are included as indicated in the form.

- Finally, review all entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Take action now and complete the Money Laundering Form online to remain compliant with regulations.

Related links form

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file a Form 8300. By law, a "person" is an individual, company, corporation, partnership, association, trust or estate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.