Loading

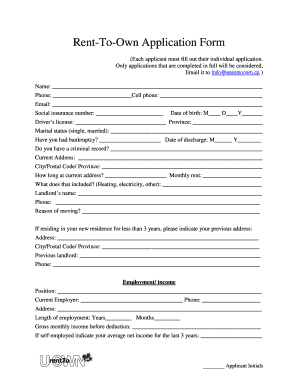

Get Rent-to-own Application Form - Urenttoown

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rent-To-Own Application Form - Urenttoown online

Filling out the Rent-To-Own Application Form can be a straightforward process when guided properly. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out your application with ease.

- Click 'Get Form' button to obtain the Rent-To-Own Application Form and open it in your preferred editor.

- In the first section, provide your personal information, including your name, phone number, cell phone number, email address, and social insurance number.

- Fill in your date of birth, driver's license number, and the province it was issued in. Indicate your marital status (e.g., single, married) to complete this section.

- Answer questions regarding bankruptcy history and any criminal records you may have, including the date of bankruptcy discharge.

- Complete your current address details, including city, postal code, and province. Specify how long you have lived at this address and indicate your monthly rent, noting what it covers.

- Provide your landlord’s name and phone number, along with your reason for moving. If applicable, indicate your previous address if you have lived at your current residence for less than three years.

- Fill out the employment and income section, detailing your current job position, employer’s name and phone number, address, length of employment, and gross monthly income.

- If self-employed, provide your average net income for the last three years. Include details from any previous employment if you've been in your current job for less than three years.

- In the financial information section, list your assets such as savings, RRSP, and vehicles. Document any liabilities including credit cards and mortgages.

- Indicate any supplemental government income, other revenue streams, and how much down payment you currently have available and can raise.

- Specify the number of people who will be occupying the new home and your intended move-in date.

- Review and authorize the application by signing and dating the authorization section. Ensure that a credit report is attached before submission.

- Finally, save your changes, download the completed form, and either print or share it via email to info@urenttoown.ca.

Start filling out your Rent-To-Own Application Form online today!

So, what creates all the curiosity about who pays property taxes in rent to own? Technically, the seller is still the owner of the home. And because of that technicality, the seller pays the property taxes until you have officially purchased the home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.