Loading

Get Vat Declaration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Declaration Form online

Filling out the Vat Declaration Form online can be a straightforward process with the right guidance. This guide provides clear, step-by-step instructions to help users accurately complete the form and ensure compliance with VAT regulations.

Follow the steps to fill out the Vat Declaration Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

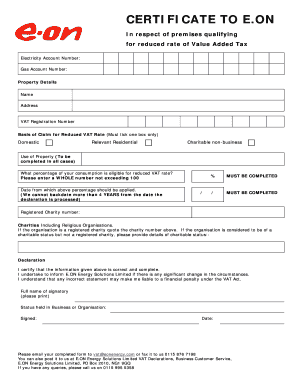

- Enter your electricity and gas account numbers in the designated fields to ensure your accounts are properly referenced.

- Provide the property details by filling in the name and address of the relevant premises. This information is necessary for identifying the location associated with the VAT claim.

- Input the VAT registration number as required. This identification is critical for processing your claim.

- Select the basis of your claim for a reduced VAT rate by ticking one box only. Your options include Domestic, Relevant Residential, or Charitable non-business.

- Complete the usage of property section by specifying the percentage of your energy consumption that is eligible for the reduced VAT rate. Ensure this is a whole number not exceeding 100.

- Fill in the date from which the above percentage should be applied. Note, the date cannot be backdated by more than four years.

- If applicable, include the registered charity number. If your organization is not a registered charity but has charitable status, provide those details.

- Carefully read the declaration statement. Confirm the accuracy of all provided information and understand the implications of submitting incorrect statements.

- Print or type the full name of the signatory, note the status held in the business or organization, and include the signature along with the date.

- Review the completed form for accuracy and make any necessary adjustments.

- Once satisfied, proceed to save changes and choose to download, print, or share the form as needed.

Complete your Vat Declaration Form online to ensure your claim for reduced VAT rates is processed effectively.

Overview standard rate. reduced rate. second reduced rate. zero rate. livestock rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.