Loading

Get G2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the G2 Form online

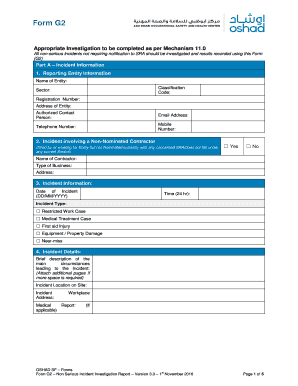

Filling out the G2 Form online can streamline your reporting process for non-serious incidents. This guide offers you a clear, step-by-step approach to ensure that you provide all necessary information accurately and efficiently.

Follow the steps to complete the G2 Form online effectively.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- Enter the reporting entity information in Part A. Fill in the name of your entity, classification code, sector, registration number, address, and authorized contact person's details, including email and phone numbers.

- If the incident involves a non-nominated contractor, indicate 'Yes' or 'No' and provide the contractor's name, type of business, and address if applicable.

- Record the date of the incident in the format DD/MM/YYYY, followed by the time in a 24-hour format.

- Select the type of incident from the options provided: restricted work case, medical treatment case, first aid injury, equipment/property damage, or near-miss.

- In the incident details section, provide a brief description of the incident's circumstances, including the incident location and address.

- If there are injured persons, enter their personal details, ensuring to indicate their occupation, relationship with the entity, nationality, date of birth, passport number, length of service, contact information, and gender.

- Complete Part B by detailing the incident causes. Select the applicable immediate causes from the provided list for unsafe acts and unsafe conditions.

- Describe the nature of the injury or illness, including the location of the bodily injury and the mechanism of injury.

- List actions taken immediately after the incident, along with the corresponding responsibilities and completion dates.

- Identify and list root causes, corrective actions needed to prevent recurrence, and associated costs for the incident.

- Finally, review all entries for accuracy, save the completed form, and choose to download, print, or share it as needed.

Start filling out your G2 Form online today to ensure efficient incident reporting!

This form is for withholding on Distributions to Nonresident members and shareholders.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.