Loading

Get Irs Form 1024 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 1024 Fillable online

This guide provides a comprehensive approach to completing the IRS Form 1024 Fillable, used by organizations seeking tax-exempt status under section 501(a). It offers clear, step-by-step instructions for each section of the form to ensure a smooth application process.

Follow the steps to successfully complete your IRS Form 1024 Fillable online.

- Click the 'Get Form' button to obtain the form and open it in your preferred online editor.

- In Part I, provide the full name and address of your organization exactly as it appears in the creating documents. Include your Employer Identification Number (EIN). If your organization does not have an EIN, indicate 'applied for' and attach a statement with the application date.

- Complete the contact information section by providing the name and telephone number of a person who can be contacted if additional information is needed.

- In Part II, describe all activities conducted by the organization. Include detailed narratives that outline how these activities further your exempt purposes.

- Fill out the financial data in Part III, detailing revenue and expenses for the current tax year and the previous three years. Attach schedules as required.

- If applicable, complete Part IV regarding notice requirements for organizations applying under section 501(c)(9) or 501(c)(17).

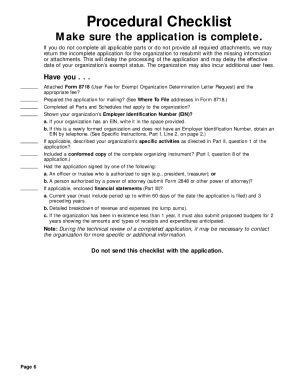

- Review your completed form for accuracy and completeness. Make sure to attach Form 8718 with the necessary user fee.

- Finally, save your changes, download a copy, print it for your records, or share it as needed.

Start filling out your IRS Form 1024 Fillable online today and ensure your organization receives its tax-exempt status.

Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(4).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.