Loading

Get F1040sf.pdf - Schedule F(form 1040 Department Of The Treasury ...

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F1040sf.pdf - SCHEDULE F (Form 1040 Department Of The Treasury) online

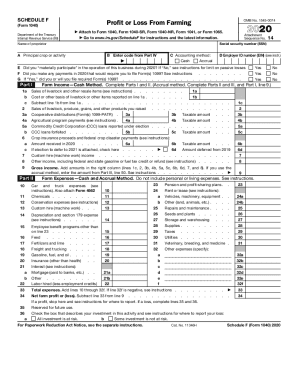

Filling out the F1040sf.pdf - SCHEDULE F form is essential for reporting profit or loss from farming activities. This guide provides clear, step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to successfully complete your Schedule F form.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Begin by entering your personal information at the top of the form. This includes your name, social security number, and principal crop or activity code, which you can find in Part IV.

- Select your accounting method in section C: either Cash or Accrual, based on your business practices.

- Provide your Employer Identification Number (EIN) in section D, if applicable. Then, indicate whether you materially participated in the farming business during the tax year in section E.

- Complete Part I by reporting your sales of livestock and products raised. You will need to calculate your total gross income by summarizing the values in the right column of lines 1c through 8 into line 9.

- Move on to the farm expenses section. In Part I, enter expenses related to farming, ensuring you do not include personal or living expenses.

- Add all expenses reported from lines 10 through 32f in Part II to calculate the total expenses on line 33.

- Determine your net farm profit or loss by subtracting total expenses (line 33) from your gross income (line 9) on line 34.

- If you have a profit, follow the instructions to report it. If you have a loss, check the appropriate box indicating your investment risk in section B and complete lines 35 and 36.

- Once you have reviewed the completed form for accuracy, you may save the changes, download a copy, print it, or share it as needed.

Complete your farming documents online efficiently and ensure compliance with IRS regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Schedule K-1 is an Internal Revenue Service (IRS) tax form that's issued annually. It reports the gains, losses, interest, dividends, earnings, and other distributions from certain investments or business entities for the previous tax year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.