Loading

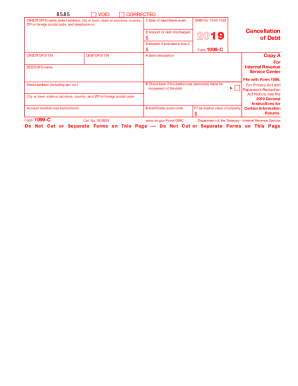

Get 2019 Form 1099-c. Cancellation Of Debt

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Form 1099-C. Cancellation of Debt online

Filling out the 2019 Form 1099-C is important for reporting the cancellation of debt to the IRS. This guide offers a clear, step-by-step approach to help you successfully complete the form online.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the creditor's name, address, and telephone number in the designated fields. Ensure that the information is accurate and complete.

- Fill in the date of the identifiable event in box 1. This is the date when the debt was discharged or the earliest identifiable event.

- Report the amount of debt discharged in box 2. Make sure this amount is correct as it directly affects your tax reporting.

- If interest is included in the discharged debt, indicate the amount in box 3. If not, you can leave this blank.

- Describe the debt in box 4. Be as specific as possible to provide clarity on the nature of the debt.

- Check box 5 if the debtor was personally liable for repayment of the debt.

- Select the appropriate identifiable event code in box 6. Refer to the IRS instructions for the specific code related to the discharge of debt.

- If applicable, enter the fair market value of property related to the debt in box 7.

- Review all entered information for accuracy, then save changes. You can download the completed form, print it for your records, or share it as needed.

Complete your documents online to ensure timely and accurate filing.

Related links form

In some cases, your forgiven debt is taxable – and in some it's not. When it is taxable nonbusiness debt, you'll use the copy of the 1099-C to use to report it on Schedule 1 of Form 1040 as other income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.