Loading

Get Nys Unclaimed Funds Table Of Heirs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Unclaimed Funds Table Of Heirs online

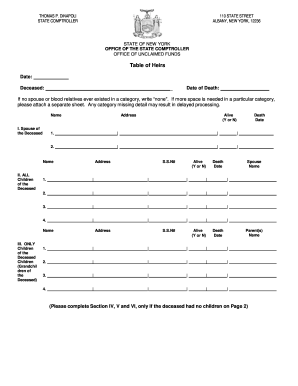

Filling out the Nys Unclaimed Funds Table Of Heirs is an important step for individuals claiming unclaimed funds from a deceased relative. This guide provides clear instructions to help you navigate the form with ease.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- In the first section, fill in the deceased person's name and date of death. Ensure accuracy, as this information is critical.

- Continue to the first subsection titled 'Spouse of the Deceased.' Here, provide the name, address, Social Security number (if applicable), whether they are alive (indicate 'Y' or 'N'), and the date of death if applicable for each spouse.

- Next, proceed to the second subsection for 'All Children of the Deceased.' Repeat the same process as in step 3 for each child, including their spouse's name if applicable.

- In the third subsection, input information regarding 'Only Children of the Deceased Children' (grandchildren). Fill in the necessary details for each grandchild.

- If there are no children, move on to fill out the 'Parents of the Deceased' section, including their details as required.

- Then complete the section for 'All Brothers and Sisters of the Deceased' following the same format.

- Lastly, if applicable, complete the section entitled 'Only Children of the Deceased Brothers and Sisters.'

- At the end of the form, identify yourself as the person completing it and provide your relationship to the deceased along with your address.

- Sign and date the form in the designated areas. Additionally, considering including your Social Security number or Taxpayer Identification Number to streamline processing.

- Finally, save your changes, and choose to download, print, or share the completed form as necessary.

Get started on filling out your Nys Unclaimed Funds Table Of Heirs online today!

Claiming Unclaimed Property in New York In New York, property is generally presumed abandoned if there has been no activity in the account for a set period of time, usually between two and five years. However, this time limit varies depending on the type of property involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.