Loading

Get Pa 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA 1 Form online

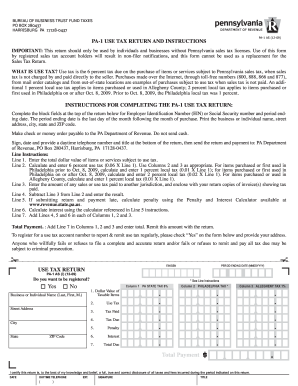

Filling out the PA 1 Form online is a straightforward process that allows individuals and businesses to report use tax for purchases where sales tax was not charged. This guide provides clear, step-by-step instructions to help you successfully complete the form.

Follow the steps to complete the PA 1 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by completing the top block fields. Enter your Employer Identification Number (EIN) or Social Security number, and the period ending date, which should be the last day of the month following your month of purchase. Provide your business or individual name, street address, city, state, and ZIP code.

- Proceed to Line 1. Enter the total dollar value of the items or services that are subject to use tax.

- For Line 2, calculate the 6 percent use tax based on the value entered in Line 1. Depending on where the items were purchased, apply local taxes: for items in Philadelphia before Oct. 8, 2009, enter 1 percent; for purchases on or after this date, enter 2 percent. For Allegheny County items, enter 1 percent.

- In Line 3, input the amount of any sales or use tax that has been paid to another jurisdiction. Remember to attach copies of invoices that show tax paid with your return.

- Line 4 requires you to subtract the amount from Line 3 from Line 2 to find your tax due.

- If the return and payment are submitted late, calculate the penalty to be entered in Line 5 using the Penalty and Interest Calculator, which is available online.

- Calculate any interest owed based on instructions in Line 6, using the provided calculator.

- In Line 7, add the amounts from Lines 4, 5, and 6 for each column.

- Lastly, total the amounts from Line 7 in each column to determine your Total Payment. Remit this amount along with your return.

- At the bottom of the form, provide your signature, date, daytime telephone number, and title. Send the completed return and payment to the Pennsylvania Department of Revenue at the designated address.

Complete your documents online for a smoother filing experience.

Pennsylvania personal income tax is levied at the rate of 3.07 percent against taxable income of resident and nonresident individuals, estates, trusts, partnerships, S corporations, business trusts and limited liability companies not federally taxed as corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.