Loading

Get Borrowing Base Certificate Template

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Borrowing Base Certificate Template online

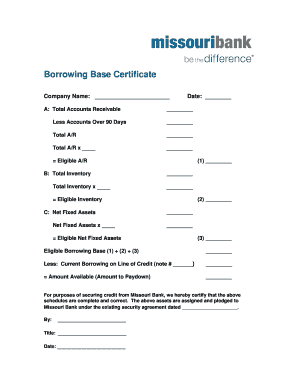

Filling out the Borrowing Base Certificate Template is essential for securing credit. This guide will provide you with clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the Borrowing Base Certificate Template and open it in your preferred online document editor.

- In the first section labeled 'Company Name', enter the name of your organization accurately.

- Fill in the 'Date' field with the current date to indicate when the certificate is being filled out.

- Calculate 'Total Accounts Receivable' and enter the amount in the designated space.

- Subtract any accounts receivable that are over 90 days overdue and write this amount in the appropriate field.

- Complete 'Total A/R' by calculating the total after adjustments and record this amount.

- Next, multiply the 'Total A/R' by the percentage specified in the field next to it and note the result.

- For section B, calculate the 'Total Inventory' and enter that number.

- Multiply 'Total Inventory' by the percentage indicated and document this amount.

- In section C, enter the value of 'Net Fixed Assets' and perform the multiplication by the specified rate, recording the outcome.

- Calculate the 'Eligible Borrowing Base' by adding the eligible amounts from sections A, B, and C.

- Deduct any current borrowing on the line of credit (noted as 'note #') from the 'Eligible Borrowing Base' to determine the 'Amount Available' for paydown.

- Finally, certify the information provided by signing in the designated area, adding your title and the current date.

Complete your Borrowing Base Certificate Template online today and secure your credit efficiently.

For example, your lender might count the $50,000 you are owed as $30,000 in collateral, and let you borrow up to $80,000. In that case, your borrowing base calculation would be $50,000 (your cash in the bank) plus $30,000 (the “eligible” collateral amount, as deemed by the lender, of the money you are owed).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.