Loading

Get Return Of Mistaken Distribution - Fidelity Investments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Return Of Mistaken Distribution - Fidelity Investments online

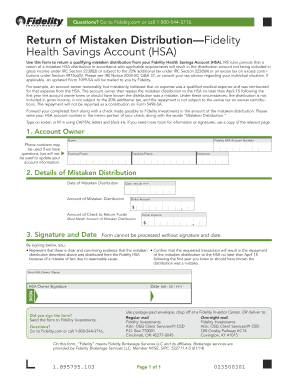

Completing the Return Of Mistaken Distribution form for your Fidelity Health Savings Account (HSA) is a straightforward process. This guide will walk you through each step of the form, ensuring you provide all necessary information for a successful submission.

Follow the steps to fill out the form accurately.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, enter your name and phone numbers. Note that phone numbers may be used for follow-up questions but will not update your account information. Also, provide your Fidelity HSA account number along with your evening and daytime phone numbers.

- Proceed to Section 2 to detail the mistaken distribution. Enter the date of the mistaken distribution in the format mm dd yyyy and specify the dollar amount of the mistaken distribution. Ensure that the amount of check to return funds matches the mistaken distribution.

- In Section 3, sign and date the form. It is mandatory to provide your signature and the date for the form to be processed. By signing, you confirm that the mistaken distribution occurred due to a mistake of fact and you will return it to the HSA by April 15 following the year you were aware of the mistake.

- Once all sections are complete, save your changes. You may choose to download, print, or share the form as needed. Ensure you attach a check made payable to Fidelity Investments for the mistaken distribution amount and include your HSA account number along with the words 'Mistaken Distribution' in the memo portion.

Complete your Return Of Mistaken Distribution form online today to ensure a smooth processing of your correction.

You are permitted to reimburse yourself for qualified medical expenses from an HSA account as long as the expenses were incurred after the HSA account was established, Seltzer said in an email. There is no time limit on when you can reimburse yourself for these expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.