Loading

Get Nc-3 - Annual Withholding Reconciliation Note: Form Has ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC-3 - Annual Withholding Reconciliation online

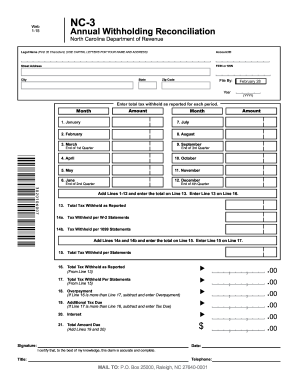

The NC-3 - Annual Withholding Reconciliation is a crucial form for reporting total withholding taxes in North Carolina. This guide provides a step-by-step approach to help you fill out the form accurately and efficiently online.

Follow the steps to complete the NC-3 form online.

- Click the ‘Get Form’ button to access the NC-3 form and open it in an online editor.

- Enter your legal name in capital letters (first 32 characters) along with your account ID, street address, and either your FEIN or SSN. Ensure that all information is accurate and complete for clarity.

- Provide your city, state, and zip code next to the address section to ensure proper identification and filing.

- Indicate the year you are filing for by entering the four-digit year (YYYY) in the designated space.

- In the section labeled 'Total tax withheld as reported for each period', record the total tax withheld for each month from January to December. Ensure that the entries match your records for accuracy.

- Add the amounts from lines 1 to 12 and enter the total on Line 13. This total must also be reported on Line 16.

- Check your W-2 and 1099 statements to fill out lines 14a and 14b accurately. Add these figures together and report the result on Line 15 as well as Line 17.

- On Line 18, calculate any overpayment by subtracting Line 17 from Line 16, if applicable.

- If there are additional taxes due, indicate them on Line 19 by subtracting Line 16 from Line 17.

- Report any interest amount on Line 20, and then calculate the total amount due by adding Lines 19 and 20 on Line 21.

- Sign and date the form in the designated area to certify the accuracy of the information provided. Include your title and telephone number if applicable.

- After checking that all information is correct, save your changes and download a copy of the completed form or print it for submission. Ensure to mail it to the provided address, P.O. Box 25000, Raleigh, NC 27640-0001.

Start filling out your NC-3 form online today for a smooth filing experience.

FORM NC-4 EZ - You may use this form if you intend to claim either: exempt status, or the N.C. standard deduction and no tax credits or only the credit for children. FORM NC-4 NRA - If you are a nonresident alien you must use Form NC-4 NRA. FORM NC-4 BASIC INSTRUCTIONS - Complete the Allowance Worksheet.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.