Loading

Get Back Pay Calculation Sheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Back Pay Calculation Sheet online

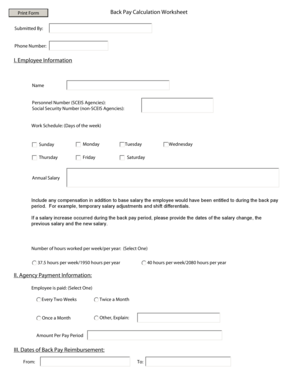

Completing the Back Pay Calculation Sheet online is essential for accurately determining back pay owed to an employee. This guide provides clear instructions to help users navigate each section of the form effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Start with the Employee Information section by entering the full name of the employee, their personnel number, and social security number if applicable. Also, specify their work schedule by checking the relevant boxes for the days they work.

- In the Annual Salary field, input the total salary the employee would have received during the back pay period, alongside any additional compensation such as temporary salary adjustments and shift differentials. Provide details of any salary changes that occurred during this period, including the dates and amounts.

- Select the appropriate option indicating the number of hours the employee works per week and per year. This can be either 37.5 hours per week (1950 hours per year) or 40 hours per week (2080 hours per year).

- Move to the Agency Payment Information section. Specify how often the employee is paid by selecting the appropriate option. If the payment frequency is 'Other', please provide a brief explanation.

- Enter the Amount Per Pay Period in the designated field to indicate how much the employee earns each pay period.

- Proceed to the Dates of Back Pay Reimbursement section. Enter the start and end dates for the back pay period in the respective fields.

- Complete the table provided, filling out Columns A through F with necessary details. Include pay period dates, number of workdays in that period, total amount owed, salary already paid, and the calculated back pay due.

- Review the subtotal and enter any comments that may provide additional context regarding the back pay owed.

- Finally, document any other wages or unemployment compensation under Less UC / Other Wages, and calculate the final Total amount due. If necessary, attach additional pages and a notarized statement.

- After confirming all entered data is accurate, save changes, and download or print the completed form for your records.

Complete your Back Pay Calculation Sheet online today and ensure accurate compensation for employees.

Determine the number of pay periods they have in a year. Divide an employee's wage by the number of pay periods to figure out the amount they make each pay period. Multiply this amount by the number of pay periods the employee is owed back pay for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.