Loading

Get Form 43709 Voucher

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 943 Voucher online

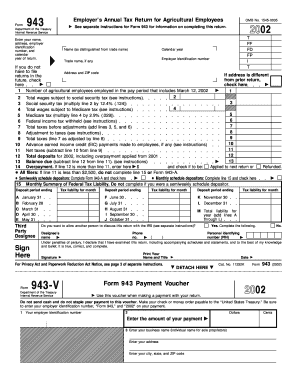

Filling out the Form 943 Voucher online is an essential step for employers who are submitting their annual tax return for agricultural employees. This guide provides a clear, step-by-step approach to help users efficiently complete the form, ensuring all necessary information is accurately provided.

Follow the steps to complete the Form 943 Voucher online:

- Click ‘Get Form’ button to access the form and open it on your device.

- Enter your name in the designated field, ensuring it is distinguished from your trade name if applicable.

- Provide your employer identification number accurately in the corresponding box.

- Fill in your complete address, including the ZIP code.

- Indicate the number of agricultural employees employed in the pay period that includes March 12 of the tax year.

- Detail the total wages subject to social security tax and calculate the corresponding social security tax based on the given percentage.

- Complete the section for total wages subject to Medicare tax and calculate the Medicare tax accordingly.

- Report the federal income tax withheld.

- Add the amounts from the previous tax sections to obtain total taxes before adjustments.

- If applicable, adjust the taxes according to the provided instructions.

- Calculate the net taxes by subtracting any advance earned income credit payments made to employees from the total taxes.

- Input the total deposits for the year and determine any balance due or overpayment.

- If payments are made with this form, complete the payment voucher section accurately.

- Sign and date the form to finalize it.

- After finishing the form, save your changes and download it. You have the option to print or share the completed form as necessary.

Start filling out the Form 943 Voucher online today to ensure compliance with your tax obligations.

Form PD7A, Remittance Voucher – Statement of Account for Current Source Deductions for regular, quarterly and monthly remitters. Form PD7A(TM), Remittance Voucher – Statement of Account for Current Source Deductions, or Form PD7A-RB, Remittance Voucher for accelerated remitters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.