Loading

Get Ver 1.1 National Pension System (nps) Subscriber ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

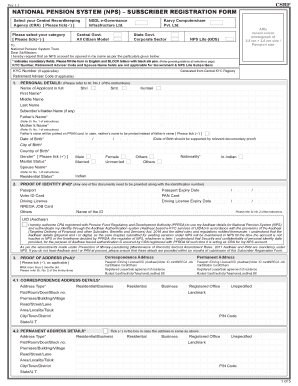

How to fill out the Ver 1.1 National Pension System (NPS) Subscriber Registration Form online

This guide provides clear instructions for completing the Ver 1.1 National Pension System (NPS) Subscriber Registration Form online. Following these steps will ensure that you accurately fill out the required fields and successfully submit your application.

Follow the steps to fill out the NPS Subscriber Registration Form online.

- Click ‘Get Form’ button to download the NPS Subscriber Registration Form and open it in your preferred format.

- Select your Central Recordkeeping Agency (CRA) by ticking the appropriate box for either NSDL e-Governance Infrastructure Ltd. or Karvy Computershare Pvt. Ltd.

- Indicate your subscriber category by selecting the relevant box, whether you are a government, all citizen model, state government, or corporate sector subscriber.

- Affix a recent color photograph of size 3.5 cm × 2.5 cm or passport size in the designated area.

- Complete the personal details section. Fill in your name according to the order of first, middle, and last names. Provide your father’s name and mother’s name as required.

- Enter your date of birth, city of birth, and country of birth in the specified format. Tick the appropriate gender and marital status options.

- Provide proof of identity by selecting one of the acceptable documents and entering the identification number. Ensure to also include the expiry date if applicable.

- Fill in your correspondence address and permanent address, ticking the box if both are the same. Make sure to select the type of address and include relevant details.

- Enter your contact details, including mobile number and email address, ensuring they are accurate for communication purposes.

- Provide your occupation details, income range, and educational qualifications, selecting the desiring options that apply to you.

- Fill in your bank details, including account type, bank name, and branch address. Bank details are mandatory if you intend to activate a Tier II account.

- Complete the nomination details section if applicable, indicating nominees and their relationship to you.

- If opting for a Tier II account, indicate your choice and, if desired, the Pension Fund selection along with your investment option.

- Review and agree to the declaration by signing and dating the form, ensuring it is done in black ink.

- Once the form is completed, save all changes, then download, print, or share the form as needed.

To complete your application, ensure all steps are followed and submit the NPS Subscriber Registration Form online.

All citizens of India between the age of 18 and 60 years as on the date of submission of his / her application to Point of Presence (POP) / Point of Presence-Service Provider (POP-SP) can join NPS .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.