Loading

Get Texas Franchise Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Franchise Tax online

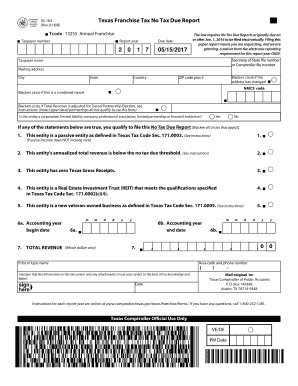

Filing the Texas Franchise Tax No Tax Due Report online is essential for entities not liable for taxes. This guide provides a comprehensive, step-by-step process to help you accurately complete the form and meet your filing requirements.

Follow the steps to fill out the Texas Franchise Tax form with ease.

- Press the ‘Get Form’ button to obtain the Texas Franchise Tax form and open it for editing.

- Fill in your taxpayer number, which is essential for identifying your unique account. Ensure that the report year and due date are accurate, as this information validates your submission.

- Complete the taxpayer name and mailing address fields. If your address has changed, mark the corresponding circle. Provide your city, state, and ZIP code with the additional four digits.

- Enter the NAICS code that corresponds to your business activities. This code assists in identifying your industry classification.

- Mark if this is a combined report or if your total revenue is adjusted for the Tiered Partnership Election by blackening the appropriate circles.

- Indicate whether your entity is a corporation, limited liability company, professional association, limited partnership, or financial institution by selecting 'Yes' or 'No.'

- Assess the eligibility criteria and mark all applicable exemptions that qualify you to file this No Tax Due Report.

- Fill in the accounting year begin and end dates, ensuring accuracy in the mm/dd/yyyy format.

- Input the total revenue amount, rounding to whole dollars only.

- Provide your area code and phone number for contact purposes. Then, declare the accuracy of the information by signing and dating the form.

- Finalize your filing by saving the completed form. You can download, print, or share your document as needed before mailing the original to the Texas Comptroller of Public Accounts.

Complete your Texas Franchise Tax form online today to ensure timely filing and compliance.

certain grantor trusts, estates of natural persons and escrows; real estate mortgage investment conduits and certain qualified real estate investment trusts; a nonprofit self-insurance trust created under Insurance Code Chapter 2212; a trust qualified under Internal Revenue Code Section 401(a);

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.