Loading

Get Va Loan Comparison Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va Loan Comparison Worksheet online

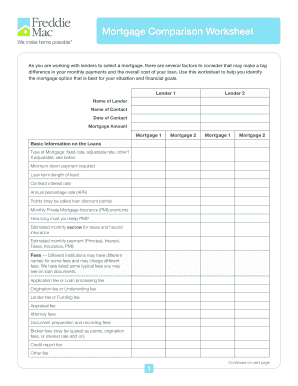

The Va Loan Comparison Worksheet is an essential tool for individuals analyzing mortgage options from various lenders. This guide provides straightforward steps for completing the worksheet online to ensure users make informed financial decisions.

Follow the steps to complete the Va Loan Comparison Worksheet effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the details for Lender 1 and Lender 2 in the provided sections, including the names of the lenders and contact information.

- Under 'Basic Information on the Loans,' specify the type of mortgage for both lenders (e.g., fixed-rate, adjustable rate), minimum down payment required, loan term, contract interest rate, annual percentage rate (APR), and any points or mortgage insurance premiums.

- List typical fees associated with the loans in the 'Fees' section, including application fees, appraisal fees, and any other charges specified.

- Complete the 'Other Costs at Closing/Settlement' section by estimating costs such as title insurance and taxes.

- In the 'Other Questions and Considerations about the Loan' section, carefully note any prepayment penalties, lock-in agreements, and terms regarding adjustable-rate mortgages.

- Review all information filled in for accuracy to ensure it meets your analysis needs.

- Once completed, save changes, download your worksheet, print it out for your records, or share it with a financial advisor.

Take control of your mortgage options by filling out the Va Loan Comparison Worksheet online today.

VA loans are perfect for those who qualify wanting a loan with no down payment and fewer closing costs. Yet if you do have a down payment of 20 percent, you should consider another choice, avoiding the funding fee charged on all VA loans.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.