Loading

Get Cd Prep Checklist Encompass.xlsx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CD PREP CHECKLIST ENCOMPASS.xlsx online

Filling out the CD PREP CHECKLIST ENCOMPASS.xlsx is an essential step in ensuring that all necessary information is accurately recorded for successful loan processing. This guide will walk you through the process of completing this checklist efficiently and effectively, providing you with the support you need along the way.

Follow the steps to complete the CD PREP checklist with ease.

- Press the ‘Get Form’ button to access the CD PREP CHECKLIST ENCOMPASS.xlsx and open it in the online editor.

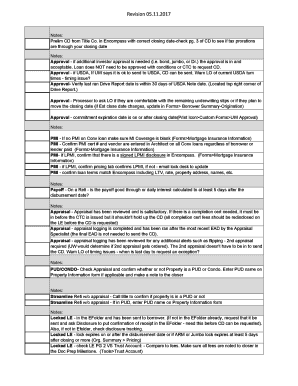

- Review the preliminary CD to ensure it reflects the correct closing date. Check page 3 for tax prorations and confirm they are up to your closing date.

- Verify if additional investor approvals are needed for the loan type. If so, ensure the approvals are acceptable before proceeding.

- Check the most recent Drive Report date, making sure it is within 30 days of the USDA Note date, as indicated at the top right corner.

- Ask the loan officer if they are comfortable with any remaining underwriting stipulations or if they plan to adjust the closing date; update the date in the Forms section if necessary.

- For private mortgage insurance (PMI), confirm that the MI Coverage is blank if there is no PMI on a Conventional loan and ensure that all relevant information is entered in the PMI section.

- On refinance cases, verify that the payoff is adequate for at least 5 days after the disbursement date.

- Check the appraisal for satisfactory review and make sure if a completion certificate is required, it is submitted before issuing the clear to close (CTC) but does not delay the CD.

- Confirm whether the property is in a planned unit development (PUD) or condominium, and enter the relevant PUD name if applicable.

- Verify that the locked Loan Estimate (LE) has been correctly filed, confirming it is present in the e-folder and sent to the borrower.

- Ensure all pertinent information regarding title company selection is complete, including confirming the closing email address and verifying wire details.

- Double-check the closing disclosure (CPL) for accuracy in property address, borrower names, and company address.

- Confirm that the title commitment's effective date is current and matches the other documents in the file.

- Complete any special notes to closing if necessary, including lender credits, escrows, and any other special conditions.

- Once all fields are filled, save your changes, and select an option to download, print, or share the completed form.

Complete your documents online to ensure a smooth and efficient closing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.