Loading

Get Loan Application Form - Providers Multi-purpose ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LOAN APPLICATION FORM - Providers Multi-Purpose online

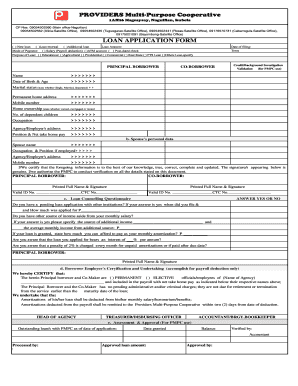

This guide provides a user-friendly, step-by-step process for completing the Loan Application Form for Providers Multi-Purpose. Properly filling out the form ensures that your application is processed smoothly and efficiently.

Follow the steps to complete your loan application form effectively.

- Click the ‘Get Form’ button to access the loan application form and open it in an online editor.

- Indicate the type of loan you are applying for by checking the appropriate box: New loan, Loan renewal, or Additional loan.

- Fill in the Loan Amount requested and choose your Mode of Payment, selecting from Salary (Payroll deduction), ATM account, or Post-dated check.

- Enter the Date of filing and the Term of the loan.

- State the Purpose of Loan by selecting one or more options: Educational, Agricultural, Providential, Commercial, Real Estate, PTS Loan, or Others (please specify).

- Complete the Principal Borrower's section with personal information including Name, Date of Birth & Age, and Marital Status.

- If applicable, fill out the Co-Borrower's section with their details.

- Complete the Loan Counselling Questionnaire by answering yes or no to the provided questions, ensuring all relevant details are specified.

- Sign the certification acknowledging the truthfulness of the provided information at the bottom of the form.

- For payroll deduction applications, ensure the Borrower Employer's Certification and Undertaking section is completed as required by your employer.

- After filling out the form, review all entered information for accuracy.

- You can now save changes, download, print, or share the completed application form as necessary.

Start filling out your loan application form online today to ensure a smooth application process.

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.