Loading

Get Pheaahardship Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pheaahardship Form online

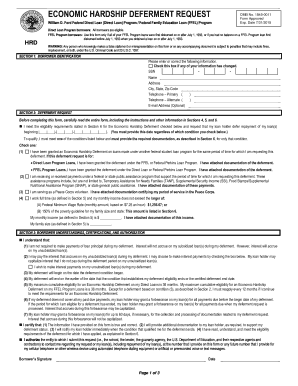

Completing the Pheaahardship Form online is a straightforward process designed to help individuals request a deferment on their federal student loans due to economic hardship. This guide offers a clear approach to ensure all required information is accurately filled out.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin by entering your borrower identification details in Section 1. Fill in your Social Security Number, name, address, city, state, zip code, primary and alternate telephone numbers, and optionally, your email address. If any of your information has changed, ensure to check the provided box.

- Move to Section 2 to submit your deferment request. Specify the date your deferment should begin and check the condition that applies to your eligibility for the Economic Hardship Deferment. Provide any required documentation as described in Section 6 to support your chosen condition.

- Complete Section 3, which includes your understandings and certifications regarding the deferment. You must certify that the information provided is accurate and you understand the implications of the deferment, including how it affects interest on your loans.

- Refer to Section 4 for further instructions. Ensure that all dates are formatted as month-day-year. Include your name and account number on any additional documentation you attach.

- After completing all sections, review the entire form for accuracy. Make necessary corrections if needed.

- Finally, save any changes you made, and print or share the form as necessary. Follow the instructions in Section 7 to return the completed form and any required documentation to your loan holder.

Start filling out your Pheaahardship Form online now to achieve the financial relief you need.

It is a circumstance in which the annual amount due on your eligible loans, as calculated under a 10-year Standard Repayment Plan, exceeds 15 percent (for IBR) or 10 percent (for Pay As You Earn) of the difference between your adjusted gross income (AGI) and 150 percent of the poverty line for your family size in the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.