Loading

Get Boe 401 Ez

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 401 Ez online

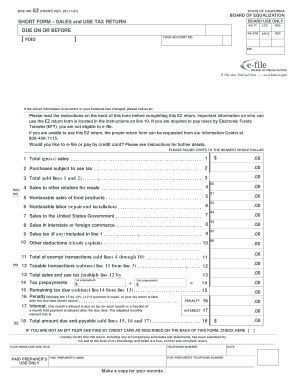

This guide provides a clear and supportive walkthrough for users filling out the Boe 401 Ez form online. Whether you are familiar with tax forms or new to this process, this comprehensive guide will help you accurately complete your sales and use tax return.

Follow the steps to complete the Boe 401 Ez form online.

- Press the ‘Get Form’ button to access the Boe 401 Ez form and open it in your browser.

- Begin by verifying that all pre-filled information in the form is correct. If there are discrepancies in your business information, contact the Board for assistance.

- Move to line 1 and enter your total (gross) sales, rounding cents to the nearest whole dollar as specified.

- Proceed to line 2 to report purchases that are subject to use tax. List the total purchase price of any items you bought without paying California sales tax.

- On line 3, sum the amounts from lines 1 and 2, then input the total.

- For line 4, input any sales made to other retailers for resale, ensuring you have valid resale certificates.

- Complete line 5 by entering nontaxable sales of food products. Be careful to exclude alcoholic or carbonated beverages and other ineligible food sales.

- Line 6 is for reporting nontaxable labor charges, such as installation works or repairs.

- On line 11, total the exempt transactions by adding lines 4 through 10 and enter the result.

- Calculate your taxable transactions for line 12 by subtracting the total from line 11 from the total on line 3.

- Multiply the taxable amount on line 12 by the applicable tax rate and enter this figure on line 13.

- If you have made any tax prepayments, report these amounts on line 14.

- Subtract line 14 from line 13 to determine any remaining tax due on line 15.

- If applicable, calculate any penalties for late filing on line 16, which is 10% of the amount due.

- Calculate interest for late payments to enter on line 17, based on the number of months payment is delayed.

- Finally, total lines 15, 16, and 17 to get the total amount due on line 18, which is your final calculated amount.

- Review all entered information for accuracy before signing. After confirming the details, print the form, and mail it along with your payment, ensuring to keep a copy for your records.

Complete your Boe 401 Ez form online today to ensure timely submission and compliance.

The difference between these federal income tax forms is the relative simplicity of short forms 1040EZ and 1040A — compared to the longer, more complex Form 1040. Using the shorter tax forms can simplify your tax preparation. Each of these tax forms has the same set of purposes, including: Reporting your income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.