Loading

Get Pc 205b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pc 205b online

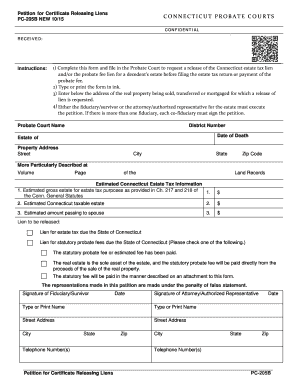

Completing the Pc 205b form is an essential step for individuals requesting a release of liens related to a decedent's estate in Connecticut. This guide offers clear instructions on how to fill out the form online, ensuring that users can navigate the process without confusion.

Follow the steps to successfully complete the Pc 205b form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Enter the required information for the Probate Court Name and District Number. Make sure to double-check the accuracy of this information.

- Record the Date of Death of the decedent in the section provided. This date is crucial for the probate process.

- Fill in the Estate of section with the name of the decedent and complete the Property Address fields, including Street, City, State, and Zip Code for the property involved.

- Provide the details of the property more particularly described at Volume and Page of the Land Records.

- Input the Estimated Connecticut Estate Tax Information, including the Estimated Gross Estate, Estimated Connecticut Taxable Estate, and Estimated Amount Passing to Spouse, ensuring all figures are accurate.

- Select the lien to be released by checking one of the options for estate tax or statutory probate fees due to Connecticut.

- Ensure the petition is signed by the Fiduciary/Survivor and the Attorney/Authorized Representative. Include their printed names, addresses, and contact telephone numbers.

- Review all entries for completeness and accuracy. Save your changes to the form, and consider downloading or printing it for your records.

Complete your documents online today and streamline your process for releasing liens!

Do All Connecticut Estates Have to Go Through Probate? Not all estates must go through the formal probate process in Connecticut. If an estate is worth less than $40,000, an affidavit from the court is all that is necessary to transfer the ownership to the heirs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.