Loading

Get Itr 5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ITR 5 online

Filing your Indian Income Tax Return using ITR 5 online can seem daunting, but with the right guidance, it can be a straightforward process. This guide will provide you with a clear, step-by-step approach to accurately complete the ITR 5 form.

Follow the steps to successfully complete the ITR 5 form online.

- Click the ‘Get Form’ button to obtain the ITR 5 form and access it in your preferred format.

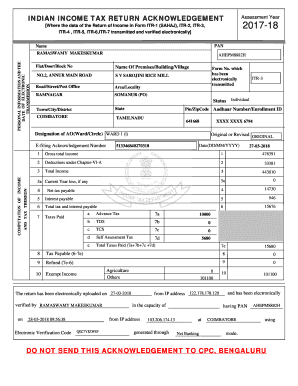

- Begin by entering your personal information, including your name and PAN. Ensure that the details match your official documents for accuracy.

- Fill in the address section with your complete residential address, including flat number, building name, city, state, and pin code.

- Provide your designation of Assessing Officer, ensuring to select the appropriate ward or circle from the options available.

- Proceed to the income computation section, filling in your gross total income, deductions under Chapter VI-A, and total income accurately.

- Enter the tax computations, including net tax payable, interest payable, and total tax and interest payable.

- Record the details of taxes paid, such as advance tax, TDS, TCS, and self-assessment tax in the designated fields.

- Finally, review all entered information for accuracy. Once confirmed, save changes, and choose to download, print, or share the completed form as necessary.

Start filling out your ITR 5 online to ensure a smooth filing experience.

ITR (Income Tax Return) is a form in which the taxpayers file information about his income earned and tax applicable to the income tax department. ... ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 & ITR 7 till date. Every taxpayer should file his ITR on or before the specified due date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.