Loading

Get Fyi Income 44

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fyi Income 44 online

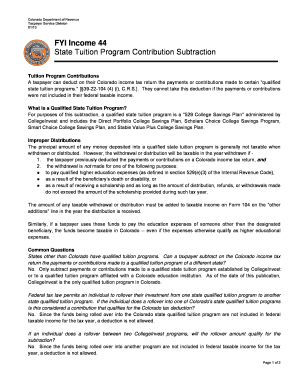

Filling out the Fyi Income 44 is an important step for taxpayers wishing to deduct their contributions to qualified state tuition programs on their Colorado income tax return. This guide will provide a clear and detailed walkthrough of the process, ensuring that you have the necessary information to complete the form successfully.

Follow the steps to fill out the Fyi Income 44 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Read the introductory information at the top of the form to understand the requirements for deductions related to qualified state tuition programs.

- Locate the section for ‘Tuition Program Contributions’ and enter the total amount of your contributions made to qualified state tuition programs in the appropriate field.

- Ensure that the contributions you are reporting were included in your federal taxable income for the year, as only those amounts are eligible for deduction.

- If necessary, refer to the definitions provided for ‘Qualified State Tuition Program’ to confirm that your contributions qualify under the defined plans.

- Review the information about improper distributions and confirm you understand the tax implications should you withdraw funds for non-qualified expenses.

- After filling out all required sections, review your entries for accuracy and completeness.

- Once confirmed, save your changes, and choose the option to download, print, or share the form according to your requirements.

Ensure your contributions are accurately reported – start filling out the Fyi Income 44 online today!

Can I get a tax deduction, or is that just for the parents? Yes, grandparents can claim the deduction for contributing to a 529 if they live in one of the 34 states that offer a state income tax deduction for 529 college-savings plan contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.