Loading

Get Canada T1036 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1036 E online

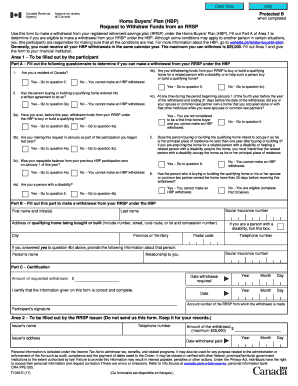

The Canada T1036 E form is essential for individuals looking to withdraw funds from their registered retirement savings plan under the Home Buyers' Plan (HBP). This guide provides a clear and structured approach to completing the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the T1036 E form online.

- Click the ‘Get Form’ button to access the T1036 E form and open it in your preferred editor.

- In Area 1, Part A, start by answering the eligibility questionnaire. Ensure you respond accurately to each question to determine if you qualify for a withdrawal.

- If you are a resident of Canada, proceed to question 2. If not, you cannot make a withdrawal.

- In question 2, confirm if there is a written agreement to buy or build a qualifying home. If not, you cannot proceed.

- Continue through the eligibility questions until you reach question 6, which determines if the home will be the principal residence of the intended occupant.

- If eligible, move on to Part B and fill out your personal information, including your name, social insurance number, and address of the home being purchased.

- If applicable, provide information about the person with a disability in Part B.

- In Part C, you will need to certify that all information provided is accurate by signing and dating the form.

- Finally, review all your entries for accuracy. Once completed, you have the option to save changes, download, print, or share the form as needed.

Complete your Canada T1036 E form online today to ensure a smooth withdrawal process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certified financial planner Jeanette Brox says young Canadians still have a good reason to withdraw from their retirement plan to buy a house: current prices. Ms. Brox, who works for Investors Group, says taking money out of an RRSP is the only way some first-time buyers can scrape together enough for a down payment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.