Loading

Get Canada T2 Sch 100 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 SCH 100 E online

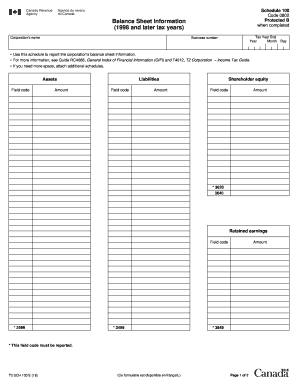

The Canada T2 SCH 100 E form is essential for corporations to report their balance sheet information. Filling out this form accurately is crucial for compliance and proper tax reporting.

Follow the steps to complete the Canada T2 SCH 100 E online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the corporation's name in the designated field at the top of the form.

- Specify the tax year end by entering the year and month. Ensure the dates correspond accurately to the reporting period.

- Input the corporation's business number where required.

- Move to the 'Assets' section. Here, you will report various asset categories by entering the amounts in the appropriate fields. Refer to the commonly used GIFI codes for assistance.

- Proceed to the 'Liabilities' section and similarly fill in the amounts under each category. Ensure accuracy by cross-referencing with accounting records.

- Complete the 'Shareholder equity' section by entering the relevant equity amounts. Again, use the provided field codes to guide your entries.

- Review all entered information for accuracy and completeness.

- Save your changes, then download, print, or share the completed form as needed.

Ensure your balance sheet is accurate — complete the Canada T2 SCH 100 E online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.