Loading

Get Canada Rc1 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC1 online

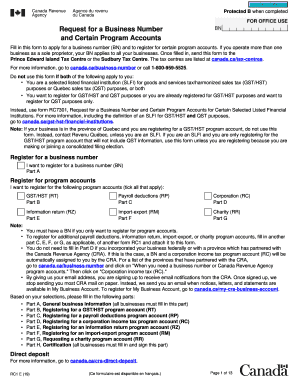

The Canada RC1 form is essential for applying for a business number and registering for various program accounts. This guide aims to provide you with clear and detailed instructions on how to effectively complete the form online, ensuring that you can navigate the process with ease.

Follow the steps to successfully complete the Canada RC1 form online.

- Press the ‘Get Form’ button to access the Canada RC1 form and open it in your preferred editing tool.

- In Part A, provide general business information including ownership type and operation type. This section requires you to select your ownership type by ticking the appropriate box.

- Still in Part A, enter the owners’ information. You need to fill in details such as the social insurance number, first name, last name, and contact numbers.

- Complete Part A3 to provide your business information. This includes your business name, business number, and physical location.

- Move to Part A4 and describe the major business activity you engage in. Be specific and use relevant details.

- In Part A5, answer all the questions related to GST/HST information, indicating whether your business requires registration.

- Proceed to Part B if you wish to register for a GST/HST program account. Fill in the details related to your program account identification.

- If you are registering for payroll deductions, fill out Part C with the pertinent information about your payroll account.

- For corporations, complete Part D, ensuring to provide all necessary identification details.

- In Part E, enter the necessary details for information return program accounts if applicable.

- If needed, complete Parts F and G for import-export and charity program account registrations.

- Finally, in Part H, certify the information you provided by signing and dating the form, then submit the completed document as instructed.

Complete your Canada RC1 form online now to ensure your business is properly registered.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

By mail or by fax To print a form, go to Form RC1, Request for a business number and certain program accounts or, to order a form, go to Forms and publications. Fill in form RC1. Once you have completed the form, mail or fax it to your nearest tax service office or tax centre.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.