Loading

Get Canada Mbt-rl1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada MBT-RL1 online

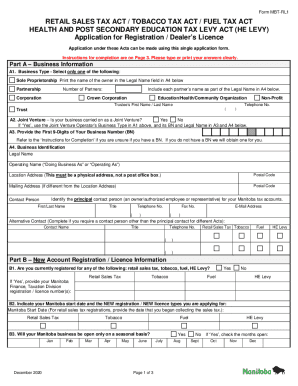

The Canada MBT-RL1 form is essential for businesses seeking to register for various tax accounts, including retail sales tax, tobacco, and fuel taxes. This guide provides clear, step-by-step instructions to help you navigate the completion of this online application efficiently.

Follow the steps to fill out the Canada MBT-RL1 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, provide your business information. Select the type of business from the options provided, such as Sole Proprietorship, Partnership, Corporation, and include the name of the business owner or partners in the Legal Name field.

- Complete A2, indicating if your business operates as a joint venture by selecting 'Yes' or 'No.' If ‘Yes,’ be sure to enter the joint venture operator’s business type, BN, and legal name in the subsequent fields.

- In A3, enter the first 9-digits of your Business Number (BN). If unsure if you have a BN, refer to the provided instructions.

- In A4, fill out the Business Identification section, including the legal name, operating name, and complete physical address of your business. If your mailing address differs, provide that as well.

- Identify the principal contact person in the contact section, ensuring to include their name, title, and contact details.

- Move to Part B, where you will answer questions related to New Account Registration and License Information. Address B1 to B3 regarding your current registrations for retail sales tax, tobacco, and fuel.

- In B4, describe your business by providing an estimated average monthly sales tax remittance and specifying the type of business activities.

- For B5, indicate all products you intend to sell, such as liquor, tobacco, and fuel, and check applicable categories.

- Finish Part B by answering questions about your payroll information in B6 and B7, including if your business will exceed a payroll of $1,500,000.

- Finally, sign in Part C to certify that the information provided is true and correct. Include the date and print your name.

- After completing all sections, ensure to save your changes, then download, print, or share the completed form as needed.

Complete the Canada MBT-RL1 form online to ensure your business is properly registered.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.