Loading

Get Canada T4 Summary 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T4 Summary online

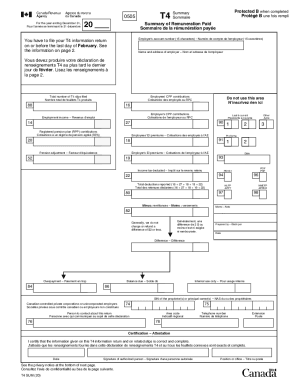

Filling out the Canada T4 Summary is an essential step for employers to report employees' earnings and deductions. This guide will walk you through the online process to ensure accuracy and compliance with tax regulations.

Follow the steps to complete your T4 Summary accurately.

- Click ‘Get Form’ button to obtain the T4 Summary and open it in your preferred format.

- Enter the employer's account number, which is 15 characters long. This number must match your payroll program account.

- Provide the name and address of the employer. Ensure this information is accurate for correspondence.

- Indicate the total number of T4 slips filed. This represents the sum of all T4 slips issued for the reporting year.

- Report employees' contributions to the Canada Pension Plan (CPP). Insert the total amount contributed by all employees.

- Document the employer's contributions to the CPP in the respective field.

- Provide the total employment income for your employees. This should reflect the total wages paid before deductions.

- Input the total amounts for registered pension plan contributions as required.

- Record the total employment insurance premiums contributed by employees.

- List any pension adjustments applicable to your employees.

- Insert the total deductions reported, which is the sum of all relevant deductions including CPP, EI, and income tax.

- Document any remittances made towards these deductions.

- If there are any differences, record these figures accurately in the difference, overpayment, or balance due sections.

- Complete the section for 'Prepared by', including the name and contact details of the person responsible for this return.

- Finally, review the completed form for accuracy. Save changes, then download, print, or share the T4 Summary as needed.

Complete your T4 Summary online today to ensure your obligations are met effectively and accurately.

If you need a T4 slip for the current tax year, your employer should be able to provide it to you. ... For previous tax years, you can request a copy from the Canada Revenue Agency (CRA) or by calling 1-800-959-8281. Get Your T4 and Other Tax Forms Online From CRA's Auto-fill my return

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.