Loading

Get Canada Gst66 E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST66 E online

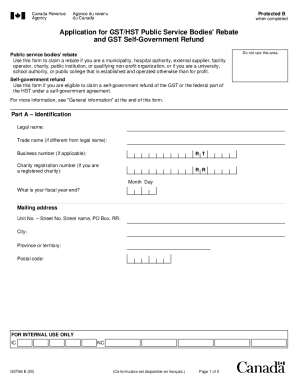

Filling out the Canada GST66 E form is essential for public service bodies to claim rebates under the Goods and Services Tax (GST) and the federal portion of the Harmonized Sales Tax (HST). This guide provides clear instructions on how to complete the form accurately and efficiently.

Follow the steps to complete your GST66 E application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part A – Identification: Enter your legal name, trade name (if applicable), and business number if you have one. If you are a registered charity, include your charity registration number. Fill in your fiscal year-end date and provide your mailing address, ensuring to include all required components like city and postal code.

- If your physical location differs from your mailing address, fill in the details in the designated section including address, city, province, and postal code.

- Designate a contact person by providing their name, title, and telephone number, including any extension if necessary.

- Move to Part B – Claim period: Specify the year and the exact dates of the claim period covered by this application.

- In Part C – Offset on GST/HST return: If applicable, indicate whether the amount on line 409 is included on line 111 of your GST/HST return, and provide the reporting period end date.

- Proceed to Part D – Details of claim: Enter the amount of rebate you are claiming for each activity you performed. Ensure you adhere to the corresponding rebate factors based on the activity types as outlined in the form.

- Calculate the total federal amount claimed by adding the amounts from lines 300 to 312. If you are claiming a provincial amount, complete it using Form RC7066 SCH and add it to your total.

- In Part E – Certification: Certify the accuracy of the information provided by printing your name, indicating your title, and signing the document. Include your telephone number and any extension.

- Once all parts are filled out, review the information for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your Canada GST66 E application online to ensure timely processing and submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.