Loading

Get Canada T1-adj E 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1-ADJ E online

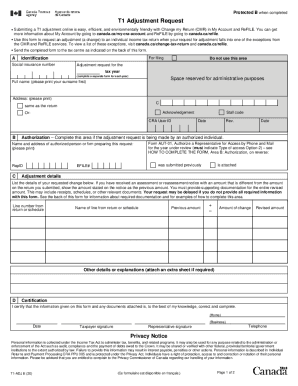

Completing the Canada T1-ADJ E form online can enhance the efficiency of submitting your adjustment request for your income tax return. This guide provides step-by-step instructions to assist users of all experience levels in accurately filling out the form.

Follow the steps to complete your adjustment request effectively.

- Click ‘Get Form’ button to acquire the Canada T1-ADJ E form and open it for editing.

- In the identification section, provide your social insurance number, full name, and address. Ensure the address matches the return you wish to adjust.

- If you are authorizing someone to submit the request on your behalf, complete the authorization section with their name and address. Submit a completed Form AUT-01 if necessary.

- In the adjustment details area, clearly list the changes you are requesting. Include the previous amounts, the adjustments being made, and the revised amounts. Attach supporting documentation as required.

- Sign and date the certification area, confirming that the information is correct and complete. Ensure that the authorized representative also signs if applicable.

- Send the completed form with any supporting documents to the correct tax centre address as indicated in the instructions based on your location.

Complete your Canada T1-ADJ E form online today for a seamless adjustment request process.

Your account should have the records of T1 General for the current year and the past 11 years that you filed under the tax returns view section. Anything older, you will need to contact the CRA directly at 1-800-959-8281 to request a copy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.