Loading

Get Au Nat 1067 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU NAT 1067 online

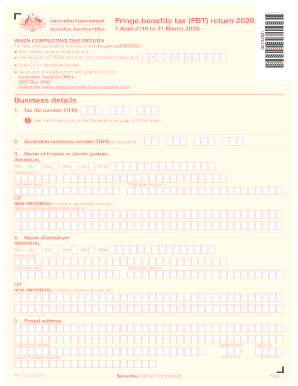

This guide provides a comprehensive overview of how to complete the AU NAT 1067 form online. It is designed to assist users with little legal experience in understanding each section of the form, ensuring a seamless submission process.

Follow the steps to successfully complete the AU NAT 1067 online.

- Click the ‘Get Form’ button to access the AU NAT 1067 form and open it in the editor.

- Begin by filling out your business details. Include your tax file number (TFN) and, if applicable, your Australian business number (ABN). Specify the name of the trustee or senior partner. Make sure to use block letters.

- Next, provide the name of the employer. Again, specify if the employer is an individual or a non-individual entity. Include the title, family name, and first given name as necessary.

- Fill in your postal address with the suburb, state or territory, and postcode. If your previous name or postal address has changed, ensure to enter the details as shown on the last FBT return lodged.

- If applicable, complete the current business or trading name and address. This step is essential if there have been changes since the last return.

- Provide the name of the contact person for this return, including their title, full name, daytime contact phone number, and email address.

- Indicate the number of employees receiving fringe benefits during the specified period and record the hours taken to prepare and complete this form.

- Answer whether you expect to lodge FBT return forms for future years by selecting 'Yes' or 'No'.

- Enter your financial institution details for electronic funds transfer (EFT). This includes the BSB number, account number, and account name.

- Proceed to calculate the fringe benefits taxable amounts and provide details as requested in the calculation sections.

- Complete the declarations section, ensuring accuracy to avoid penalties. Sign and date the employer's declaration and the tax agent's declaration as applicable.

- After reviewing all entered information for correctness, save your changes. You can choose to download, print, or share the completed form for submission.

Start filling out the AU NAT 1067 online today for an efficient tax return process!

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.