Loading

Get Crs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crs Form online

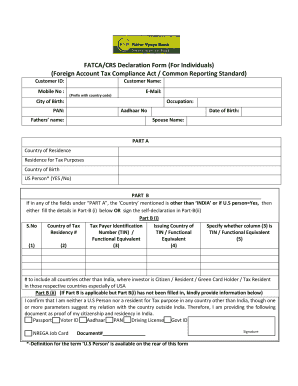

Filling out the Crs Form online is a straightforward process designed to collect essential information for tax compliance. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Crs Form online.

- Press the ‘Get Form’ button to access the Crs Form and open it in your digital editor.

- Enter your Customer ID and Mobile Number in the respective fields. Ensure to include your country code with mobile numbers for proper formatting.

- Fill in your Customer Name and Email address. Make sure your email is valid to receive confirmations or queries.

- Provide your City of Birth and Occupation in the designated fields. Accuracy in this information is crucial for proper identification.

- Input your PAN and Aadhaar numbers carefully, ensuring there are no typographical errors.

- Fill in your Father's Name and Date of Birth following the required format.

- In Part A, specify your Country of Residence for Tax Purposes, Country of Birth, and indicate whether you are a US Person by selecting 'Yes' or 'No'.

- If your Country is not ‘India’ or you marked ‘Yes’ for US Person, complete Part B (i) or sign Part B (ii) depending on your situation.

- For Part B (i), list the Country of Tax Residency, along with your Taxpayer Identification Number and the Issuing Country of that number.

- If opting for Part B (ii), confirm that you are neither a US Person nor a resident for tax purposes elsewhere and attach necessary documentation as proof.

- Review the Declaration statements thoroughly. Ensure all information is accurate and check each point box if applicable.

- Sign and date the form at the bottom. Make sure to include the place of signing.

- Once you have completed your form, you can save your changes, download a copy for your records, print it out, or share it as required.

Start filling out your Crs Form online today to ensure compliance with tax regulations.

(5) Deliver a current Form CRS to each retail investor within 30 days upon request. (c) Other disclosure obligations. Delivering Form CRS in compliance with this section does not relieve you of any other disclosure obligations you have to your retail investors under any Federal or State laws or regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.