Loading

Get Trust Certification Type Revocable Amendable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Trust Certification Type Revocable Amendable Form online

Filling out the Trust Certification Type Revocable Amendable Form online can seem daunting, but with the right guidance, it becomes a straightforward process. This guide provides clear and comprehensive instructions to help users navigate the form with ease.

Follow the steps to complete the online form successfully.

- To begin, click the ‘Get Form’ button to access the Trust Certification Type Revocable Amendable Form and open it in your preferred online editor.

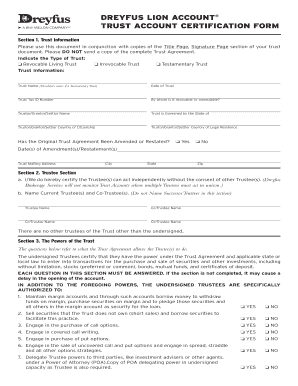

- In Section 1, provide the trust information. Indicate the type of trust by selecting one of the options: Revocable Living Trust, Irrevocable Trust, or Testamentary Trust. Fill in the trust name, date of trust, trust tax ID number, and the name of the individual who has the authority to amend or revoke the trust.

- Continue in Section 1 by filling in the governing state and country of citizenship for the trustor/grantor/settlor. Also, provide the country of legal residence and indicate whether the original trust agreement has been amended or restated.

- Enter the date(s) of any amendment(s) or restatement(s) if applicable, along with the trust mailing address, city, state, and zip code.

- Proceed to Section 2 for the Trustee section. Certify that the current Trustees can act independently by checking the appropriate box, and list the names of all current Trustees and Co-Trustees.

- In Section 3, answer all the questions regarding the powers of the trust. Each question must be answered with either 'Yes' or 'No' to confirm the powers granted under the trust agreement.

- Complete Section 4 by indicating the names of any successor Trustee(s) authorized by the trust agreement.

- Finally, in Section 5, the undersigned Trustees must read the indemnification statement and sign where indicated, providing their names, signatures, and dates. Ensure all signatures are completed as per the requirements.

- Once all sections are completed, review the form for accuracy. After checking that all information is correct, you can save changes, download, print, or share the form as needed.

Begin filling out the Trust Certification Type Revocable Amendable Form online now.

A revocable trust is a will substitute, meaning that title of assets in the trust is transferred during the lifetime of the donor even though the benefits of the assets are not enjoyed by the beneficiary until after the death of the donor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.