Loading

Get Sf3106

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sf3106 online

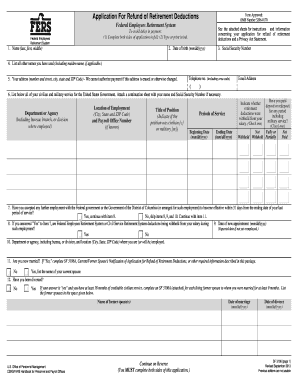

Filling out the Sf3106 form online can be a straightforward process when guided properly. This form, officially known as the Application for Refund of Retirement Deductions, is essential for those seeking a refund of their retirement contributions under the Federal Employees Retirement System.

Follow the steps to complete the Sf3106 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Complete your personal details in section 1, including your name, date of birth, and Social Security Number. Ensure accuracy to avoid delays.

- In section 4, list any other names you have used, including your maiden name, if applicable.

- Provide your current address in section 5. Remember that this address is crucial for processing your refund.

- Detail your work history in section 6, including both civilian and military service. Attach additional sheets if needed.

- In section 7, indicate whether you have accepted further employment with the Federal government within 31 days after your last service.

- If applicable, complete section 8 to confirm whether deductions are being withheld from your current salary.

- Provide marital status information in section 11. If married, complete the accompanying SF 3106A for your spouse.

- For any divorced applicants, fill out section 12 regarding previous spouses, ensuring you complete the related forms if necessary.

- Select your preferred method of receiving your refund in section 13 and ensure all checks are marked appropriately.

- After completing all sections, review the form for accuracy and completeness before saving your changes.

- Once satisfied, download and print a copy for your records or submit it directly, as required.

Begin your process of filing the Sf3106 online today for a smooth experience.

If you leave your Government job before becoming eligible for retirement: ... if you have at least five years of creditable service, you can wait until you are at retirement age to apply for monthly retirement benefit payments. This is called a deferred retirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.